Setting a New Standard for Solving Lender Compliance Issues

Voluntary Protection Products

Cancellation System

Product Cancellations

- Product cancellation notices are sent to both dealer and product providers

- Notices are automated and traceable for delivery

- Early Payoffs, Repos, Total Losses and Charge-offs trigger cancellations

- Applicable to Auto, RV, Marine and Powersports loan products

Verified Refund Quotes

- Regulators require proof of verified refund amounts

- LCT verifies the refund data thru our relationships with over 600 providers

- We access the refund quote amounts via API, batch files, calling and portal access

Quick Implementation

- Operational in days

- Workflow automation, letter templates and system defaults get you live sooner

- Dealer and Provider detailed tracking and monitoring process out-of-the-box

- Compliance and revenue KPI reporting built in

Introducing Refund Control©

Regulators are looking at F&I product refunds more and more. You should too. That’s why we’re introducing Refund Control, the lender-managed, cancellation and refund system for loan products that protects your relationships with dealers as well as your bottom line.

Non-compliance can be expensive.

The reality is state and federal regulators are ramping up scrutiny of F&I product refunds and holding lenders accountable to accurately refund consumers. The challenge for lenders is the lack of a reliable, comprehensive workflow to monitor and track the refund process from cancellation through consumer refund as required by consumer protection laws. Your time, money, and reputation are literally at stake.

A Better Workflow is Needed

F&I product cancellations due to early payoffs, repossessions, and total loss are not consistently processed, tracked, and reported. Dealers may delay or not process the cancellations at all, and administrators have different requirements for cancelling.

Consumers Need to be Made Whole

The inconsistencies of the refund process make it prone to human and operational errors, which increase the likelihood that a consumer won’t receive the correct refund they’re legally due.

Lenders Need to be Protected

Lenders have the regulatory burden to make consumers whole. Non-compliance could cost you in more ways than one.

Latest News

Latest Resources

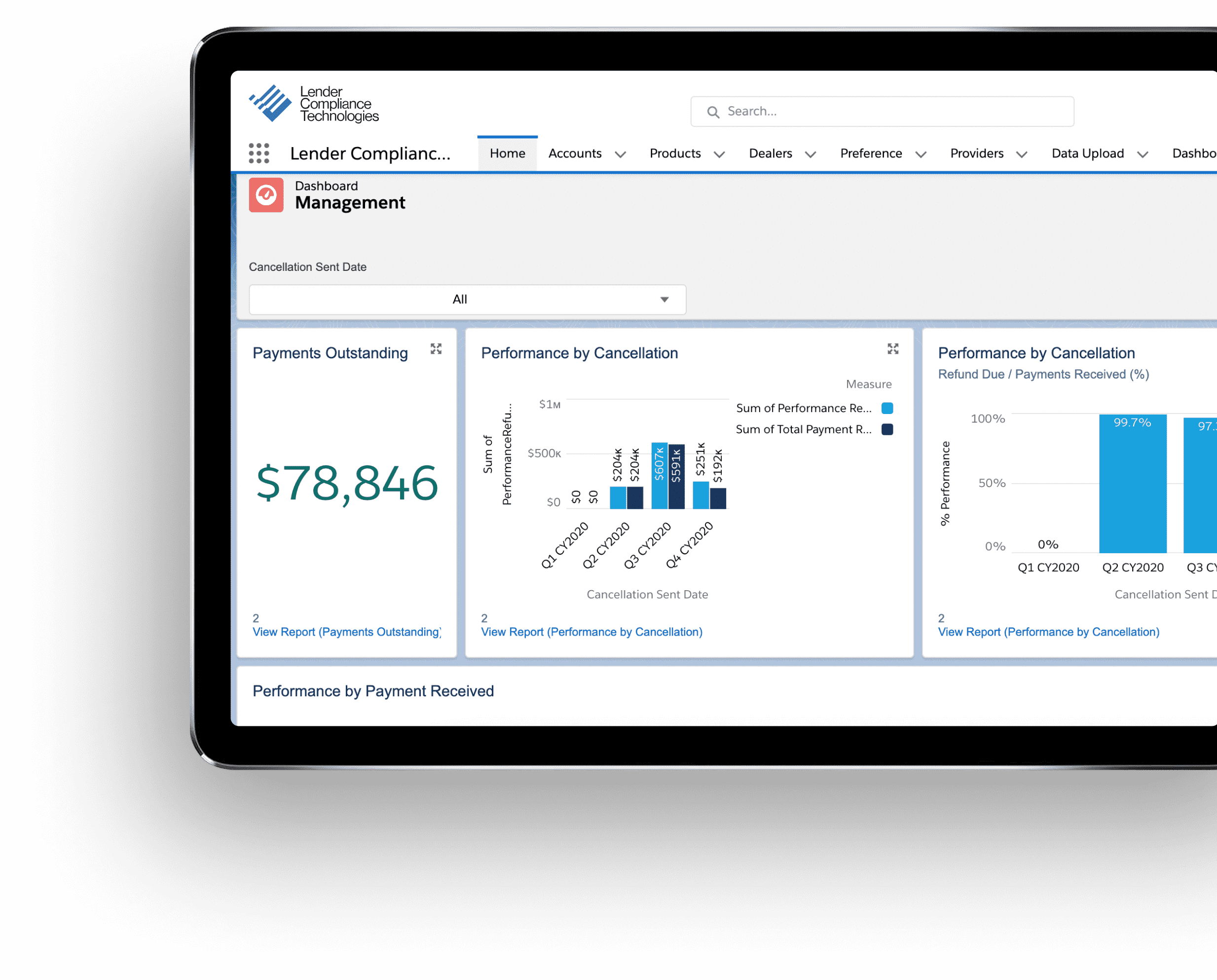

Our lender-controlled workflow works for everyone

Lenders

Lenders use Refund Control™ to submit cancellations to dealers and providers simultaneously and access refund data directly from the provider to ensure consumers have been properly credited in a timely manner.

Dealers

Dealers and providers receive product cancellation notices in real time, shaving days off of the traditional flow. Providers and dealers are empowered to move quickly to cancel requested products, getting refunds to consumers faster than ever.

Consumers

Consumers are treated fairly and receive applicable refunds in a timelier manner.

Regulators

Regulators can see lenders are using a comprehensive, auditable system of record to manage the workflow from request to refund with full transparency.

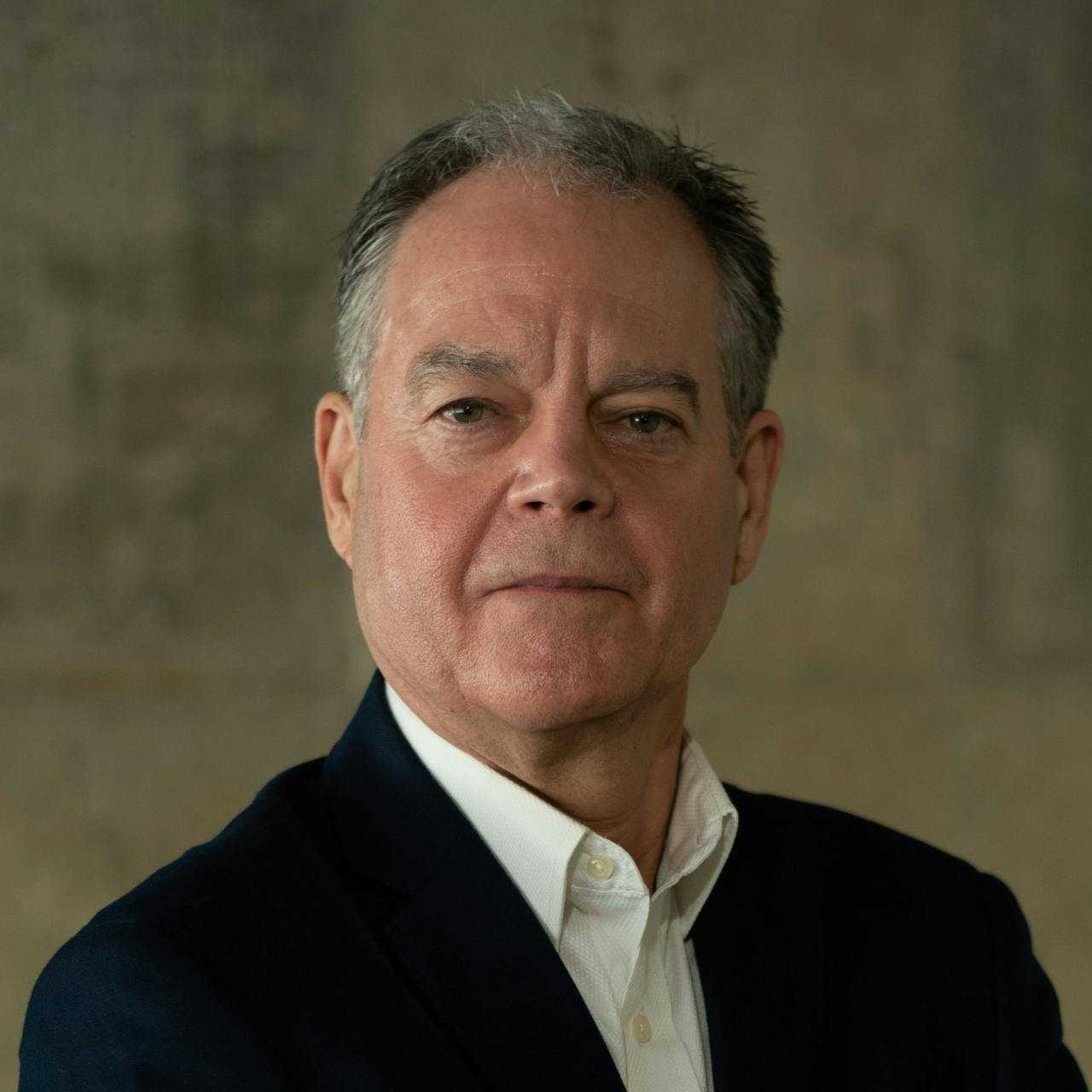

The right tech.

The right team.

History of success, developing SaaS companies

Extensive lending industry expertise

Specialists in compliance and recoveries

Focused on best practices

Request a demo of

Refund Control©

today.

Because you do have things to lose. Our comprehensive solution can help.